Company Registration in Bangladesh 2025 | Easy, Clear & Practical Guide

Are you ready to tap into the booming economy of Bangladesh by starting your own company? Congratulations on your decision to open a company in Bangladesh! This country offers incredible opportunities for businesses. With a GDP of $451 billion, Bangladesh is one of the fastest-growing economies in Asia. It also has 210 trade partners and a trade growth rate of 2.98%.

We understand that the company registration process in Bangladesh may seem complicated and lengthy. However, there’s no need to stress! Our team at Law Advisor BD will simplify everything for you. You won’t need to read other articles or watch YouTube videos. Just read this article, and you will have all the information you need to register a business in Bangladesh.

What is Company Registration in Bangladesh?

Company registration in Bangladesh is the process of officially creating a business entity. This process gives your business a legal identity. When you register your company, you can enjoy various benefits, such as:

- Legal recognition

- Access to government grants

- Ability to conduct international trade

The company registration process is done through the Registrar of Joint Stock Companies and Firms, also known as RJSC. They are responsible for ensuring that businesses meet the legal requirements to operate in Bangladesh.

Table of Contents

ToggleRequirements For Company Registration In Bangladesh

To register a company in Bangladesh, you need to meet certain requirements:

Directors

- Your company must have at least two directors.

- Directors can be either local or foreign individuals.

- Each director must be at least 18 years old.

- Directors should not have any criminal records.

- Directors must not be bankrupt.

Shareholders

- Your company needs a minimum of two shareholders.

- A maximum of 50 shareholders is allowed.

- A director can also be a shareholder.

Authorized Capital

- You must state the authorized capital in the Memorandum of Association. There is no minimum or maximum limit for authorized capital in Bangladesh.

Paid-up Capital

- The minimum paid-up capital for company registration is BDT 1. For foreign companies or investments, a higher amount may be required.

What Documents Are Required to Register a Company in Bangladesh?

To incorporate a company in Bangladesh, you need to prepare and submit multiple documents.

| Document | Purpose | Where to Obtain | Where to Submit |

|---|---|---|---|

| Name Clearance Certificate | Confirms the proposed company name is unique and approved. | Apply online through the RJSC website. | Submit to RJSC during the registration process. |

| Memorandum of Association | Defines the company’s objectives and scope of activities | Created by the company’s founders | Submit to RJSC as part of the registration documents. |

| Articles of Association | Outlines the company’s internal management and regulations. | Created by the company’s founders | Submit to RJSC as part of the registration documents. |

| Form I: Declaration on Registration of Company | Certifies that all legal requirements for registration have been complied with. | Prepared by the company | Submit to RJSC as part of the registration documents. |

| Form X: List of Persons Consenting to be Directors | Provides a list of individuals who agree to serve as directors. | Prepared by the company. | Submit to RJSC as part of the registration documents. |

| Form IX: Consent of Director to Act | Indicates each director’s consent to act on behalf of the company. | Prepared by the company. All the directors must sign this form. | Submit to RJSC with the registration application. |

| Form XII: Particulars of the Directors, Manager, and Managing Agents | Provides detailed information about the company’s directors | Prepared by the company | Submit to RJSC with the registration application. |

| Shareholders’ Information | Provides photos, photocopies of each shareholder’s NID or passports and their contact information. | Collected from each shareholder | Submit to RJSC with the registration application. |

| Registered Office Address | Mentions the official address of the company in Bangladesh. | Determined by the company. It must be a physical location in Bangladesh. | Submit to RJSC with the registration application. |

| Encashment Certificate | Verifies that the paid-up capital has been deposited into the company’s bank account. | Obtained from the bank where the company’s account is opened. | Submit to RJSC to confirm capital requirements are met. |

How Many Types of Company Registration Options Are Available in Bangladesh?

1. Companies Limited by Shares

These companies have a specific amount of share capital. The shareholders’ liability is limited to the money they have not yet paid on their shares. This means that if the company runs into financial issues, shareholders are only accountable for their unpaid share capital. Companies limited by shares include:

- Private Limited Companies: These companies restrict the transfer of shares and limit the number of shareholders.

- Public Limited Companies: They can sell shares to the public and have no limit on the number of shareholders.

2. Companies Limited by Guarantee

In these companies, the liability of members is limited to a specific amount they agree to pay if the company closes down. Companies limited by guarantee are typically used for non-profit organizations.

3. Companies with Unlimited Liabilities

In this structure, members have unlimited liability. This means that if the company has debts or obligations, members must personally pay them off without any limits. Companies with unlimited liabilities are less common in Bangladesh. This is because it poses a significant financial risk to its members.

Why Should You Register a Company in Bangladesh?

- Stable Economic Growth: Bangladesh’s economy has been growing steadily, with an expected GDP growth rate of 5.1% in 2025. This growth creates numerous opportunities for new businesses.

- Trade Agreements: Bangladesh is working hard to secure trade agreements that will improve market access. Notably, it has completed a joint feasibility study on a Free Trade Agreement with China.

- Protection of Intellectual Property: Companies that are registered can apply for trademarks, patents, and copyrights through the Department of Patents, Designs, and Trademarks in Bangladesh. This helps protect their brand, inventions, and creative work legally.

- Access to Skilled Workforce: Bangladesh has a young and skilled workforce. In 2024, the labor force is estimated to be approximately 73.75 million people. This allows new entrepreneurs to hire skilled workers at affordable rates.

- Government Agencies Help Foreigners: The Bangladesh Investment Development Authority encourages foreign investments by providing legal guidance and licensing assistance to foreign entrepreneurs.

- Government Incentives: To encourage new business incorporation, the Bangladeshi government offers various incentives, including:

- Tax exemptions

- Import duty exemptions

- Tax rebates for startups setting up in SEZs

- Seed Funding

How to Register a Private Limited Company in Bangladesh?

To set up a private limited company in Bangladesh, follow these specific procedures.

Step 1: Obtain Name Clearance Certificate

Step 2: Prepare Memorandum and Articles of Association(MoA)

Step 3: Obtain Certificate of Incorporation from RJSC

Step 4: Create a Bank Account

Step 5: Get a Trade License

Step 6: Obtain a Tax Identification Number (TIN) Certificate

Step 7: Register for VAT

Step 8: Obtain a Fire License (Optional)

Step 9: Obtain Import/Export Registration Certificates (Optional)

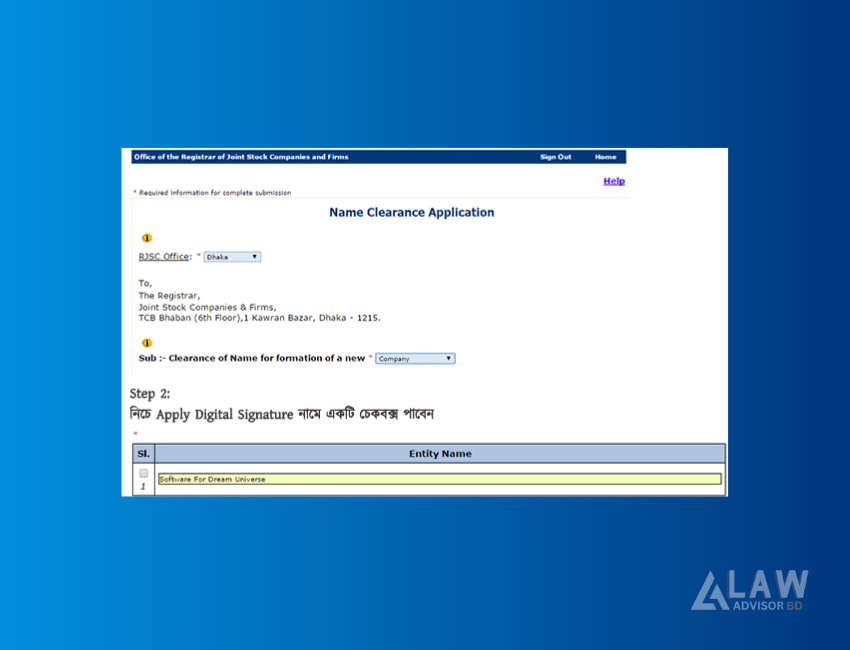

Step 1: Obtain Name Clearance Certificate

Name Clearance Certificate: A Name Clearance Certificate is an official document issued by a relevant authority that verifies the uniqueness and availability of a proposed name for a business.

Verify if your chosen company name is available on the official website of the Registrar of Joint Stock Companies and Firms. Once you have confirmed that the name can be registered, you should apply for the name clearance certificate.

You can check the status of your application online. It typically gets accepted or rejected within one business day. If your application is approved, the company name will be reserved for six months.

Process

- Step 1: Complete the online application form.

- Step 2: Next, create an E-account on the RJSC website.

- Step 3: Perform a name search on the RJSC website to check availability.

- Step 4: Make the necessary payment to BRAC Bank, One Bank or Mutual Bank.

- Step 5: Submit the payment receipt to finalize the process and obtain your name clearance certificate.

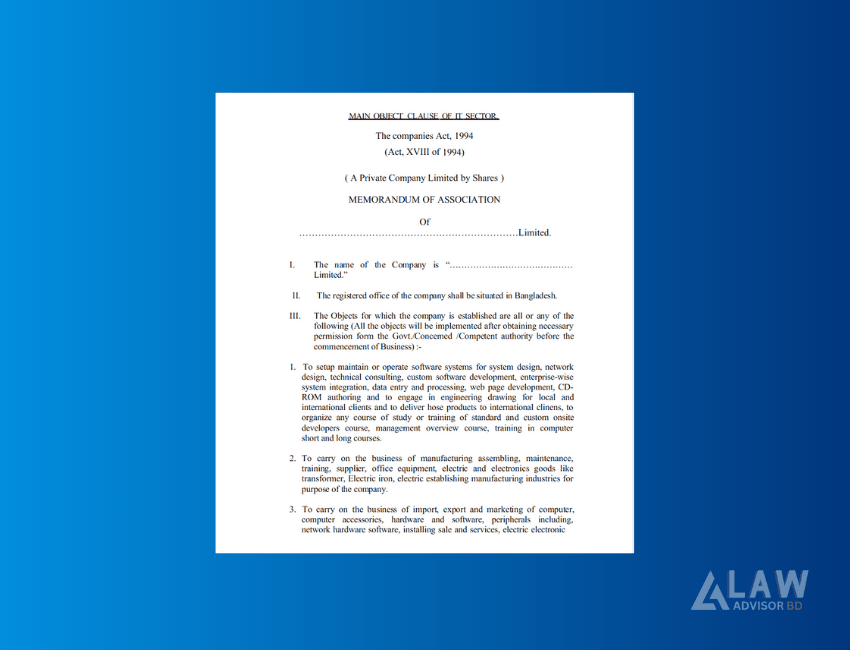

Step 2: Prepare Memorandum and Articles of Association

Memorandum of Association(MoA): The Memorandum of Association is a foundational document that specifies important information about a company, such as its name, purpose, and the relationship it has with its shareholders.

Articles of Association(AoA): The Articles of Association includes the roles and responsibilities of directors, the rights of the shareholders, and the processes for running the company.

Contact corporate law firms, such as Law Advisor BD in Bangladesh, to help you prepare your company’s Memorandum of Association and Articles of Association.

Required Documents

- The name clearance certificate

- Physical location of the company’s main office in Bangladesh

- Authorized and paid-up capital amounts.

- Distribution of shares among shareholders.

- Full names, addresses, and NID cards or passports of all shareholders and directors.

Process

- Step 1: Contact a law firm in Bangladesh

- Step 2: Gather all the necessary documents

- Step 3: Review the final draft of MoA and AoA

- Step 4: Obtain non-judicial stamps from the treasury by depositing the necessary fees through Bangladesh Bank.

- Step 5: Submit the stamped MoA and AoA to the RJSC.

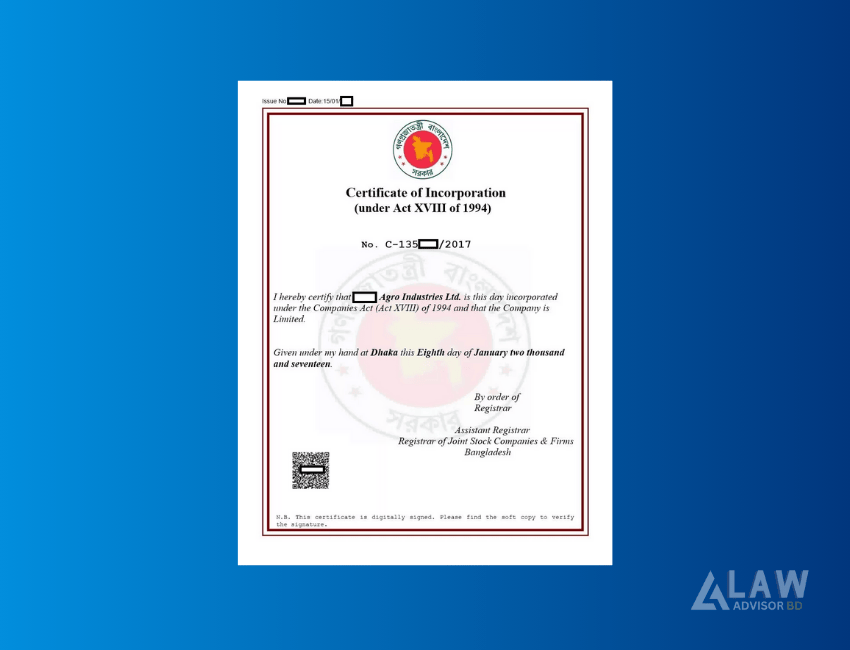

Step 3: Obtain Certificate of Incorporation from RJSC

Certificate of Incorporation: A Certificate of Incorporation is an official document that confirms the legal formation of a corporation.

Once you have the name clearance certificate and have prepared the MoA and AoA, you should collect a few additional documents and submit them to the RJSC.

Required Documents

- Name clearance certificate

- Memorandum and Articles of Association

- Completed Form I

- Completed Form VI

- Completed Form IX

- Completed Form X

- Completed Form XII

- TIN certificate for all directors

Process

- Step 1: Go to the RJSC website to apply for company registration.

- Step 2: Enter the name clearance submission number and letter number.

- Step 3: Fill out the required forms.

- Step 4: Attach the Memorandum of Association and Articles of Association.

- Step 5: Submit your registration application.

- Step 6: Pay the required fee at a designated bank and get the payment slip.

- Step 7: Upload the documents online.

- Step 8: Print the uploaded documents and submit them along with the payment slip to the RJSC office.

- Step 9: Receive your Certificate of Incorporation from the RJSC office.

Step 4: Create a Bank Account

Now, you need to open a bank account. You can do this at any bank in Bangladesh, such as:

- BRAC Bank

- Standard Chartered Bank

- Dutch-Bangla Bank Limited

- HSBC Bangladesh

Required Documents

- Certified copy of the company’s Memorandum and Articles of Association.

- Certified copy of the company’s Certificate of Incorporation.

- The most recent list of directors, including their addresses and phone numbers, along with Form XII.

- Copy of the TIN certificate.

- A resolution passed by the board of directors authorizing the opening of the account.

Process

- Step 1: Select a bank that fits your business needs and is conveniently located.

- Step 2: Collect all necessary documents.

- Step 3: Visit the nearest branch of your chosen bank with these documents.

- Step 4: Complete the account opening form provided by the bank.

- Step 5: Hand in the form along with the required documents to the bank.

- Step 6: Deposit the minimum initial amount specified by the bank.

- Step 7: Wait for your account to be activated.

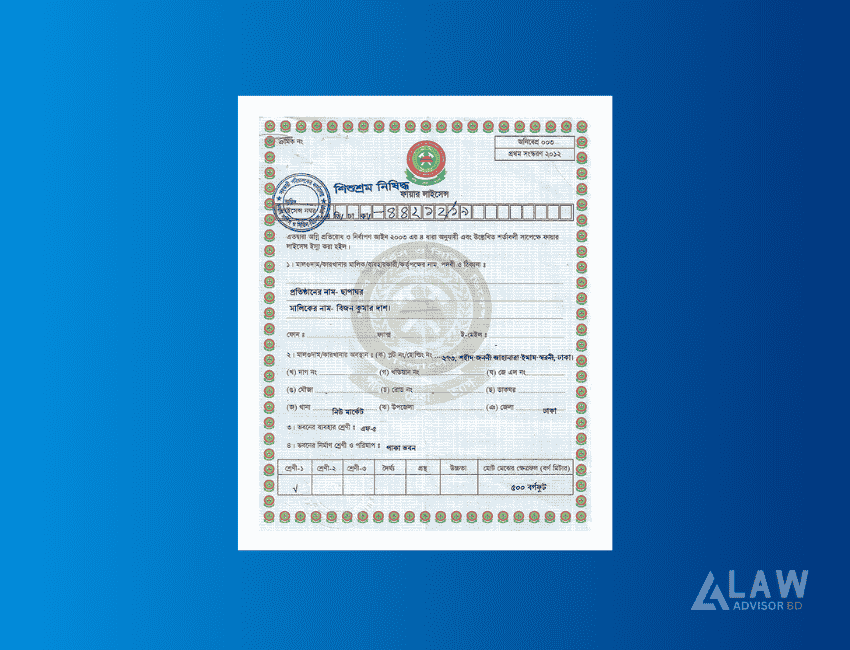

Step 5: Get a Trade License

Trade License: A Trade License is an official permit that allows a business to legally conduct specific activities or trades.

To start your business in Bangladesh, you must obtain a trade license. You must acquire the trade license from the City Corporation in your specific business location.

Required Documents

- Application form

- Copies of national ID card of the shareholders and directors

- Recent passport-sized photo of the shareholders and directors

- Declaration on a non-judicial stamp agreeing to follow the rules of the City Corporation and Municipal Corporation

- Certified copy of the memorandum and articles of association

- Copy of the certificate of incorporation

- TIN certificate

- Copy of the lease agreement for the registered office

- Bank solvency statement

Process

- Step 1: Obtain the required application form from the City Corporation, Municipal Corporation, or Union Parishad office.

- Step 2: Submit the completed application form along with the necessary documents to the appropriate section.

- Step 3: The licensing supervisor will conduct an inspection.

- Step 4: Pay the required fees at the relevant office.

- Step 5: Receive the trade license.

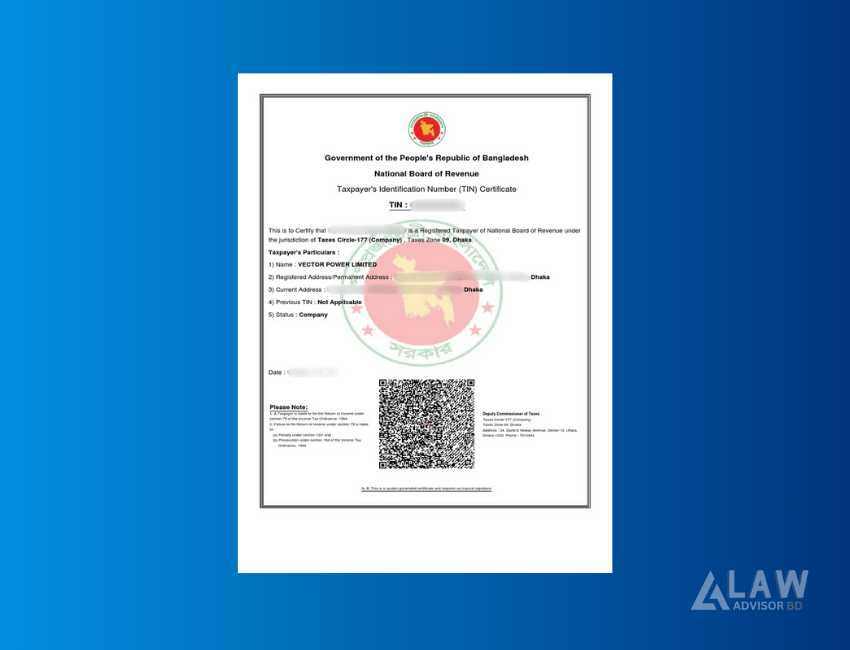

Step 6: Obtain a Tax Identification Number (TIN) Certificate

Tax Identification Number (TIN) Certificate: A tax identification number certificate verifies an individual’s or business’s unique tax identification number.

To get your TIN Certificate quickly, apply online by filling out the required form. Alternatively, you can register for taxes at your local tax authority under the National Board of Revenue to obtain your tax identification number.

Required Document

- Application form

- Copies of national ID card of the shareholders and directors

- Recent passport-sized photo of the shareholders and directors

- Certified copy of the memorandum and articles of association

- Copy of the certificate of incorporation

- Copy of the lease agreement for the registered office

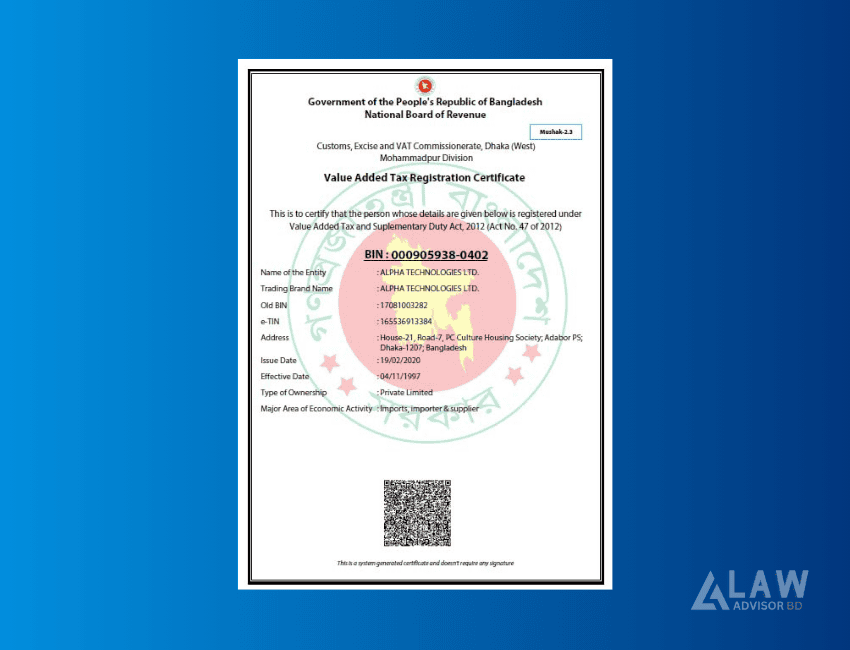

Step 7: Register for VAT

In Bangladesh, businesses must register with the Customs, Excise, and VAT Commission under the National Board of Revenue. The VAT for each company is managed by the Customs, VAT, and Excise Department in the area where the business is located.

Required Document

- Copies of national ID card of the shareholders and directors

- Recent passport-sized photo of the shareholders and directors

- Certified copy of the memorandum and articles of association

- Copy of the certificate of incorporation

- Copy of the TIN certificate

- Copy of the trade license

Process

- Step 1: Get the application form from the NBR Zonal Office or download it from the NBR website.

- Step 2: Fill out the application form and submit it along with the required documents to the Zonal Office.

- Step 3: NBR officials will review and verify your documents.

- Step 4: A physical inspection of your business location will take place.

- Step 5: Then, you will receive the VAT Registration Certificate within 6-7 days.

Step 8: Obtain a Fire License (Optional)

Fire License: A fire license is an official certificate that confirms that a building or facility meets specific fire safety standards and regulations.

You need to obtain a fire license if your business handles flammable substances or operates factories, warehouses, or any places that could pose a fire risk. It might take around 7-15 days to get the license.

Required Documents

- Trade License

- Tax Identification Number Certificate

- Company Memorandum of Association and Articles of Association

- Layout plan of the facility

- National ID or passport of the shareholders and directors

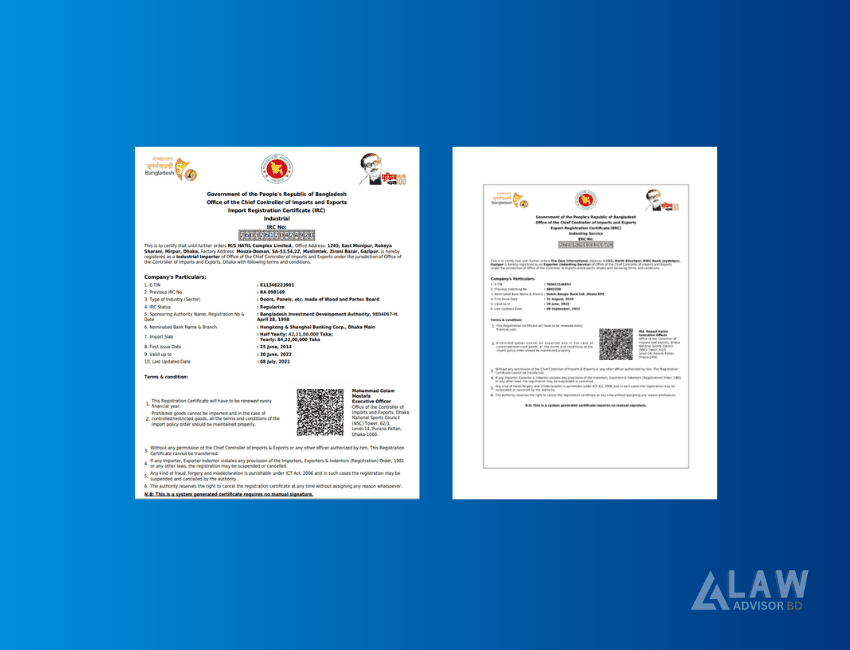

Step 9: Obtain Import/Export Registration Certificates (Optional)

Import/Export Registration Certificates: Import/Export registration certificates are official documents that authorize a business to engage in the import and export of goods across international borders.

If you plan to engage in import or export activities for your business, you must obtain:

- Import Registration Certificate

- Export Registration Certificate

Required Documents

- Trade License

- Tax Identification Number

- Company Memorandum of Association and Articles of Association

- Certificate of Incorporation

- BIDA Registration Certificate (if needed)

How to Register a Foreign Company in Bangladesh?

To register a foreign company in Bangladesh :

Step 1: Create a Temporary Bank Account

Step 2: Transfer the Required Share Capital

Step 3: Register with the BIDA

Step 4: Get Membership from Chamber of Commerce

Step 5: Apply for Employment Visas

Step 1: Create a Temporary Bank Account

If you are a foreigner, you need to create a non-operational bank account at a commercial bank in Bangladesh to transfer the necessary shareholding funds.

Required Documents

- Name Clearance Certificate

- Draft Memorandum of Association

- Draft Articles of Association

- Board Resolution

- Passports of foreign shareholders or investors

- Additional documents as requested by the bank

Process

- Choose a commercial bank in Bangladesh.

- Submit all required documents to the bank.

- Open the temporary bank account.

- If needed, complete the account opening process from abroad.

Step 2: Transfer the Required Share Capital

Share Capital: Share capital is the total amount of money a company raises by issuing shares to investors, either through common or preferred stock.

Shareholders need to transfer the minimum required share capital from overseas. The bank will provide an Encashment Certificate as evidence of the deposit. It must be submitted to the RJSC for verification.

Step 3: Register with the BIDA

If you are a foreigner looking to register a private limited company in Bangladesh or secure an industrial plot in a special economic zone, you will need to register with the BIDA.

Required Document

- A completed application form.

- A Trade License.

- A Certificate of Incorporation

- Memorandum of Association

- Articles of Association

- A background summary of the owners on official letterhead.

- A TIN Certificate.

Process

- Step 1: Get a local investment registration form.

- Step 2: Pay the registration fee at any scheduled bank and get a pay order or bank order.

- Step 3: Submit the completed application form with the necessary documents to the right department.

- Step 4: The authorities will check your application and documents.

- Step 5: If approved, you will get the Registration Certificate.

Step 4: Get Membership from Chamber of Commerce/BGMEA/BKMEA

If your foreign business is engaged in trade, exports, or certain industries like garments or textiles, you’ll need to become a member of relevant trade organizations such as:

- The Chamber of Commerce

- Bangladesh Garment Manufacturers and Exporters Association

- Bangladesh Knitwear Manufacturers and Exporters Association

Required Documents

- Trade License

- Certificate of Incorporation

- Memorandum of Association and Articles of Association

- Tax Identification Number Certificate

- Bank Solvency Certificate

Step 5: Apply for Employment Visas

Employment Visa: Employment Visa is a type of visa that permits a foreign national to enter a country for the purpose of working in a specific job.

If you want to hire foreign employees to work in Bangladesh, they will need Employment Visas. It must be sponsored by the company.

Required Documents

- Approval from the Bangladesh Investment Development Authority for your company

- Job offer letter and employment contract

- Copy of the foreign employee’s passport

- Tax Identification Number Certificate of your company

- Board resolution authorizing the hiring of foreign employees

Process

- Apply for the E-Visa at the nearest Bangladeshi embassy or consulate in the employee’s home country.

- Submit all the required documents along with the visa fees.

- Wait for approval from the Department of Immigration and Passports in Bangladesh.

- Once approved, the employee can travel to Bangladesh to start their job.

Considerations for Foreign Investors When Registering or Incorporating a Company in Bangladesh

- The company must have a local physical address in Bangladesh. This address can be residential or commercial.

- You cannot use shelf companies. All companies must be registered with clear details about their operations and activities.

- Corporate income tax rates range from 25% to 45%. The exact rate depends on the type of business and any exemptions that apply.

- You can transfer 100% of your profits and capital abroad under the Foreign Exchange Regulation Act.

- Companies in Special Economic Zones and Export Processing Zones can receive financial grants from the government.

- To hire foreign employees, you need to get work permits. These can be obtained through the Bangladesh Investment Development Authority.

- Companies that export 80% or more of their products can receive special tax benefits from the government.

Company Registration Fees in Bangladesh

1. Name Clearance Fees

- For a Company: BDT 200.00 per proposed name.

- For a Partnership Firm: BDT 200.00 per proposed name.

- For a Trade Organization: BDT 200.00 per proposed name.

- Time extension application: BDT 100

2. Preparing MoA and AoA

Private Limited Company

- For the Memorandum of Association: BDT 1000

- For Articles of Association (based on Authorized Capital):

- Authorized Capital up to BDT 20,00,000.00: BDT 3,000

- Authorized Capital more than BDT 20,00,000.00 and up to BDT 6,00,00,000.00: BDT 8,000

- Authorized Capital above BDT 6,00,00,000.00: BDT 20,000

Public Limited Company

- For the Memorandum of Association: BDT 500

- For Articles of Association (based on Authorized Capital):

- Authorized Capital up to BDT 20,00,000.00: BDT 4,000

- Authorized Capital more than BDT 20,00,000.00 and up to BDT 6,00,00,000.00: BDT 8,000

- Authorized Capital above BDT 6,00,00,000.00: BDT 20,000

Foreign Company

- For the Memorandum of Association & the Article of Association: BDT 2,000.

3. Fees to Open a Corporate Bank Account

In Bangladesh, banks usually don’t charge a fee to open a corporate bank account, but they do ask for an initial deposit. The amount can vary by bank and account type. For example:

- At Citibank, the minimum deposit for a corporate account is between BDT 2,000 and BDT 10,000.

- At Standard Chartered Bank, the minimum deposit is BDT 25,000.

4. Company Incorporation Fees

Private Limited Company

- Fee for Filing Documents: Filing 6 documents (5 filled-in forms + 1 MoA & AoA): BDT 2,400

- Fee for Authorized Share Capital:

- Authorized Capital up to BDT 20,000.00: BDT 00.00

- Additional for every 10,000.00 or part after first 20,000.00 up to 50,000.00: BDT 00.00

- Additional for every 10,000.00 or part after first 50,000.00 up to 10,00,000.00: BDT 00.00

- Additional for every 1,00,000.00 or part after first 10,00,000.00 up to 50,00,000.00: BDT 50.00

- Additional for every 1,00,000.00 or part after first 50,00,000.00: BDT 80.00

Public Limited Company

- Fee for Filing Documents:

- 8 documents (7 filled-in forms + 1 MoA & AoA): BDT 3,200.

- 9 documents (8 filled-in forms + 1 MoA & AoA): BDT 3,600.

- Fee for Authorized Share Capital:

- Authorized Capital up to BDT 20,000.00: BDT 00.00

- Additional for every 10,000.00 or part after first 20,000.00 up to 50,000.00: BDT 00.00

- Additional for every 10,000.00 or part after first 50,000.00 up to 10,00,000.00: BDT 00.00

- Additional for every 1,00,000.00 or part after first 10,00,000.00 up to 50,00,000.00: BDT 50.00

- Additional for every 1,00,000.00 or part after first 50,00,000.00: BDT 80.00

Foreign Company

- Fee for Filing Documents: 6 documents (5 filled-in forms + 1 MoA & AoA): BDT 2,400.00

Note: These fees are regulated by the Registrar of Joint Stock Companies and Firms.

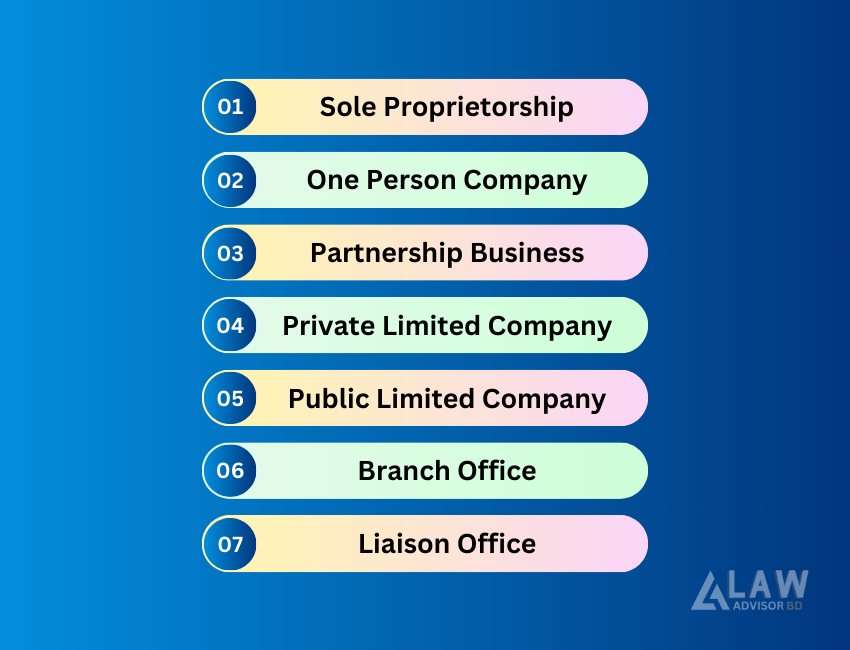

7 Most Popular Company And Business Types in Bangladesh

1. Sole Proprietorship

A sole proprietorship is the most common form of business in Bangladesh. It is owned and operated by a single individual. The owner has unlimited liability and is personally responsible for all debts and obligations of the business.

2. One Person Company

An OPC is a new business structure introduced in Bangladesh. It allows a single individual to establish a limited liability company. It’s suitable for entrepreneurs who want full control of their business while enjoying corporate protection.

3. Partnership Business

A partnership business involves two or more individuals working together to operate a business. Governed by the Partnership Act, 1932, it allows shared ownership, profits, and liabilities among partners.

4. Private Limited Company

A private limited company is owned by shareholders with liability limited to their share capital. This structure requires at least two shareholders and one director. It restricts public share trading.

5. Public Limited Company

A public limited company can sell shares to the public. This structure allows the company to raise capital by issuing shares on the stock exchange.

6. Branch Office

A branch office is an extension of a foreign company operating in Bangladesh. It must obtain approval from the Bangladesh Investment Development Authority to operate in this country.

7. Liaison Office

A liaison office acts as a communication channel between the foreign parent company and stakeholders in Bangladesh. It is prohibited from conducting commercial activities and must also obtain approval from BIDA.

Difference Between Popular Company Types in Bangladesh

| Private Limited Company | Public Limited Company | Branch Office | Liaison Office |

|---|---|---|---|

| The business is owned by 2 to 50 shareholders. | The business is owned by at least 7 shareholders | The branch is owned by a foreign parent company. | The branch is owned by a foreign parent company. |

| The shareholders’ liability is limited to their investment | The shareholders’ liability is limited to their investment | The liability is based on the parent company. | The liability is based on the parent company. |

| Taxes are applied at corporate rates. | Taxes are applied at corporate rates. | Local income is taxed as per corporate rates. | Often tax-exempt unless earning local income. |

| Foreign ownership is allowed with BIDA approval. | Foreign ownership is allowed with BIDA approval. | The branch is fully owned by the parent company. | The office is fully owned by the parent company. |

| Shares can be transferred but with restriction. | Shares can be freely transferred | Shares are not applicable. | Shares are not applicable. |

| Formal liquidation is required. | It requires a complex regulatory process. | Parent company needs to decide the exit procedure | Parent company needs to decide the exit procedure |

What Is the Most Popular Company Type in Bangladesh?

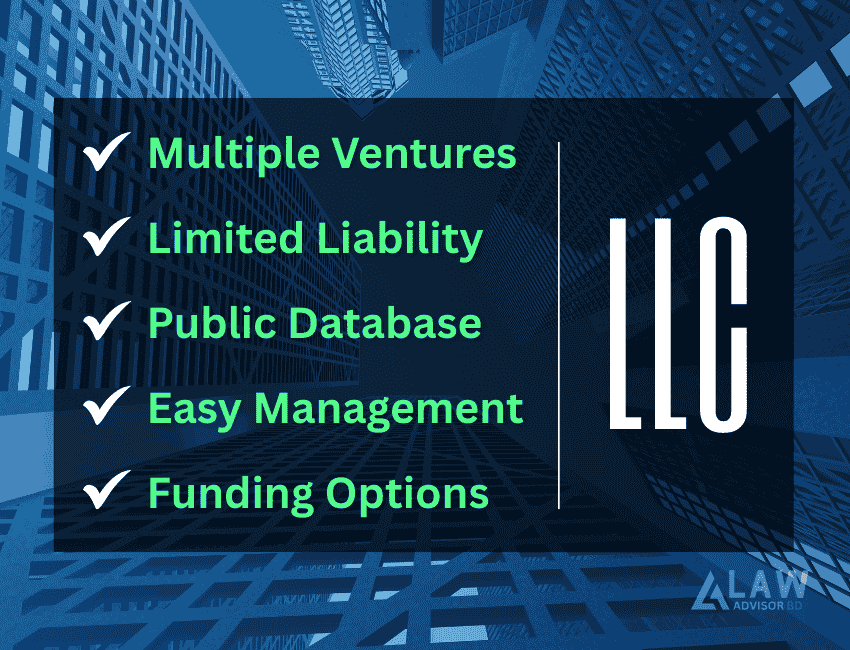

The most popular company type in Bangladesh is the Private Limited Company. Below, we have listed the reasons why it is the most popular:

- With rising business risks, many entrepreneurs prefer limited liability because it protects their personal assets. This is especially important in construction and textile industries.

- Private limited companies can quickly adjust to market changes and come up with new ideas without having to get approval from shareholders.

- Private limited companies can attract both local and foreign investors easily.

- Banks and financial institutions are more likely to lend money to private limited companies because they are well-structured and offer limited liability.

- Private limited companies are safe from hostile takeovers.

- The Bangladeshi government offers various incentives for private limited companies, such as:

- Import duty exemptions

- Corporate income tax exemptions

What Are the Benefits of Operating a Private Limited Company in Bangladesh?

1. Allows Creation of Multiple Business Ventures

Private Limited Companies have their own legal identity. This means the business is not linked to the founders. Because of this, a Private Limited Company is a good option if you want to create multiple ventures at the same time.

2. Shareholders Bear Limited Liability

As a shareholder in a Private Limited Company, your liability is limited to the amount you invested. This protects your personal assets in case the company faces losses or is dissolved.

3. Information is Easily Accessible

You can access information about all Private Limited Companies in Bangladesh through a government-managed public database. Since it’s maintained by a government authority, you can rely on this information.

4. Business Can Be Managed by Directors

In a Private Limited Company, you can own the shares while someone else takes care of running the business. This allows you to concentrate on other important tasks while the directors manage the company.

5. Multiple Funding Opportunities

Private Limited Companies have the option to raise money by issuing equity shares. This means you can attract funding from different sources, such as:

- Angel investors

- Venture capitalists

- Bootstrapping

What Is Mandatory to Do After Registering a Company in Bangladesh?

| Category | Timeline | Detail |

|---|---|---|

| Mandatory Requirements | ||

| Obtain Tax Identification Number | Within 30 days | It is required for all financial transactions and tax compliance purposes. |

| Create Corporate Bank Account | Immediately after company incorporation | It is necessary to maintain all the business transactions and financial records. |

| Obtain the Trade License | Within 30 days | It is the official business permit issued by the City Corporation. |

| VAT Registration | Before starting operations | VAT registration is mandatory for businesses with an annual turnover exceeding BDT 80 lakh. On the other hand, businesses with an annual turnover between BDT 30 lakh and BDT 80 lakh must register for Turnover Tax. |

| Get the Environmental Clearance Certificate | Before starting operations | Business owners must obtain this certificate before starting and operating any industrial unit or project. |

| Recommended Requirements | ||

| Business Insurance Coverage | Within first quarter | It protects business assets and operations |

| Business Website Development | Within first 6 months | Entrepreneurs can invest in website development, setting up corporate email, and building a social media presence |

| Develop Human Resource Structure | Within first quarter | Business owners can develop employment contracts, workplace policies, and organizational structure |

| Accounting System Implementation | Before starting business operations | Entrepreneurs can implement accounting software and hire qualified accountants. |

| Optional Considerations | ||

| Copyright Registration | When necessary | It protects the brand’s creative works. |

| Get the Fire Safety License | When necessary | Ensures your business premises meet fire safety standards and emergency protocols. |

| Additional Branch Registration | Before starting business operations | It is necessary if you want to open new branch offices for your company in different locations within Bangladesh |

How to Check Company Registration in Bangladesh?

To check a company’s registration in Bangladesh, follow these steps:

- Step 1: Visit the official website of the Registrar of Joint Stock Companies and Firms.

- Step 2: Look for the “Search” option on the homepage.

- Step 3: Enter the company name or registration number in the provided search field.

- Step 4: Click on the search button to submit your query.

- Step 5: Review the search results to find the company you are looking for.

- Step 6: Click on the company name to view detailed registration information.

How to Open a Company in Bangladesh?

To open a company in Bangladesh, you can follow these steps:

- Step 1: You should create a detailed business plan. This plan should clearly outline your business objectives and strategies for reaching your target market in Bangladesh.

- Step 2: Then, determine the legal structure of your business. You can choose to open a sole proprietorship, partnership business, or private limited company.

- Step 3: Select a unique name for your business. The name must comply with the regulations set by the Registrar of Joint Stock Companies and Firms. You can check name availability on their official website.

- Step 4: Prepare the necessary documents for company registration in Bangladesh. After that, submit your application to the RJSC along with the required fees.

- Step 5: After registration, apply for a Tax Identification Number from the National Board of Revenue. This number is essential for all tax-related activities.

- Step 6: If your projected annual turnover exceeds BDT 80 lakh, you must register for VAT through the National Board of Revenue

- Step 7: Visit a local bank to open a business bank account. This account must be in the name of your registered company for all financial transactions.

- Step 8: You should also obtain any specific licenses or permits. This may include environmental permits, trade licenses, or industry-specific certifications.

- Step 9: Select a suitable location for your office and secure a lease or purchase agreement for the space.

- Step 10: Determine the equipment and supplies you need to run your business. Then, buy or lease these items so you have everything ready for operations.

- Step 11: Evaluate the number of employees you need based on your business plan. Start the hiring process to recruit qualified employees. Make sure to comply with Bangladesh labor laws.

- Step 12: Develop a marketing strategy to promote your business. You can use different social media platforms to reach your target audience.

- Step 13: Now, officially launch your business.

Frequently Asked Questions

What is the process for registering a company in Bangladesh?

- Name Clearance

- Memorandum of Association (MoA)

- Certificate of Incorporation from RJSC

- Opening Bank Account

- Execution of documents

- Article of Association (AoA)

- Directors’ consent form

- Additional licenses and registrations

- Trade License

- Tax Identification Number (TIN)

- VAT Registration Certificate

- Fire Certificate

- Import/Export Registration Certificate

Environmental Clearance Certificate (if required)

What is an Incorporation Certificate in Bangladesh?

An incorporation certificate is an official document that confirms your company is legally registered. It is issued by the Registrar of Joint Stock Companies and Firms.

What Is the process of online company registration In Bangladesh?

You need to submit an application through the RJSC’s online portal. Then, upload the required documents and pay the registration fees electronically.

What Is the minimum paid up capital for a Private Limited Company in Bangladesh?

In Bangladesh, the minimum paid-up capital required for a local private limited company is just BDT 1. However, for foreign-owned or invested private limited companies, the minimum paid-up capital is set at USD 50,000.

What is limited by shares companies in Bangladesh?

Limited by shares companies are those where the liability of the shareholders is limited to their investment. This protects their personal assets from company debts.

How long does it take to register a company in Bangladesh?

Under normal circumstances, the complete company registration process in Bangladesh can take approximately 2 to 4 weeks. It’s important to note that this is an estimated duration and can vary based on specific circumstances.

How to start a small business in Bangladesh?

To start a small business in Bangladesh, first do some market research. Then, choose a business structure that fits your needs. Next, register your company with the Registrar of Joint Stock Companies and Firms. You will need to obtain a trade license and other licenses. After that, open a business bank account.

What is the fee for registering a company in Bangladesh?

The registration fee depends on the type and authorized share capital of the company. You should check the RJSC fee structure for specific details.

Can I change the name of my registered company later?

You can change the name of your registered company by applying to the RJSC and following the necessary procedures.